-

Charles D. Baker

-

"Harvard Pilgrim CEO Charles Baker announces bid for governor"

By Matt Viser and Andrew Ryan, Boston Globe Staff, July 8, 2009

Harvard Pilgrim Health Care chief executive Charles D. Baker announced to his staff today that he will leave his job and seek the Republican nomination for governor.

In an internal message sent to Harvard Pilgrim employees, Baker outlined his decision and said that his last day at the company would be July 17, 2009.

"I know you know I've given this issue a lot of thought, and in the end, I love working here," Baker wrote in the message. "But I also recognize the terrible financial and operational strain that will face state and local government in the years ahead. I know both sectors pretty well -- better than most, I would say -- and I believe I can bring ideas, energy and leadership to the tasks that face state government in the years ahead."

Baker has not chosen a running mate, according to one of his advisers who spoke on the condition of anonymity because he was not authorized to speak about the announcement. The adviser said Baker plans to open a campaign committee July 28, 2009, after taking a weeklong family vacation.

"He’s in the race for governor," the adviser said.

Baker could not be immediately reached for comment, but he has scheduled a press conference this afternoon at Harvard Pilgrim headquarters in Wellesley. Republicans seemed downright giddy about Baker’s decision to get in the race, comparing him to Governor William F. Weld running in 1990 after 16 years of Democrat’s in the corner office.

"I think a lot of people just breathed a big sigh of relief," said Senate Minority Leader Richard Tisei, a Republican from Wakefield. "This means there is going to be a debate in this election as to whether or not the last 2 1/2 years the state has been on the right path -- or should we change directions. I think Charlie is the perfect person to explain why we need to change directions."

Baker spent eight years in state government in the Cabinets of Weld and Governors Paul Cellucci. He served first as secretary of health and human services and then as secretary of administration and finance during some of the Big Dig.

Baker flirted with a run for governor four years ago, almost mounting a challenge to then-Lieutenant Governor Kerry Healey for the GOP nomination. Baker announced he would not run at the end of August 2005 because he and his wife, Lauren, decided that a campaign would put an "unfair burden" on their family. They have two teenage sons and a young daughter.

Baker has served one three-year term as selectman in his hometown of Swampscott. He received a bachelor's degree in English from Harvard College and a master’s degree in management, concentrating in public administration and finance, from Northwestern’s Kellogg School.

In the fight for the GOP nomination, Baker joins Christy Mihos, a convenience store magnate from West Yarmouth. Mihos garnered 7 percent of the vote when he ran for governor as an independent in 2006. Mihos announced in April that he would run in 2010 as a Republican.

On Tuesday, the Globe reported that State Treasurer Timothy P. Cahill plans to leave the Democratic Party this week in what is probably a first step toward an independent challenge to Governor Deval Patrick, a Democrat, in next year's election. The news set off a massive scramble as potential candidates for treasurer tried staking a claim on frontrunner status.

-

-

Baker

-----

-

-

Baker at Babson College on 7/8/09. (John Tlumacki/Boston Globe Staff).

-

"Harvard Pilgrim CEO Charles Baker announces bid for governor"

By Matt Viser and Andrea Estes, Boston Globe Staff, July 8, 2009

Harvard Pilgrim Health Care chief executive Charles D. Baker announced today that he will leave his job and seek the Republican nomination for governor in the 2010 election.

"I'm in," Baker said at a press conference this afternoon at Babson College in Wellesley. "I'm very well suited for this task. And I would regret it -- for quite a while -- if under such difficult circumstances I chose to sit idly by and not participate."

Baker said he would run in the mold of former Governor William Weld, who was a fiscal conservative but held more liberal stances on social issues. He deflected several questions about Democratic Governor Deval Patrick, but said he would focus on jobs and the economy and retaining young workers.

"It's a pretty dark picture," he said of the economy. "And I don't think we're doing the things we need to do to make that picture better."

"My crystal ball isn't telling me what the election in 2010 is fundamentally and ultimately going to be about. But I can tell you right now, it ought to be about jobs and the economy and the business climate because a state that can't grow jobs and can't keep its young people is in deep, deep, serious long-term trouble. That's what I see when I look at Massachusetts right now," he said.

Republicans seemed downright giddy about Baker’s decision to get into the race, comparing him to Weld running in 1990 after 16 years of Democrats in the corner office.

"I think a lot of people just breathed a big sigh of relief," said Senate Minority Leader Richard Tisei, a Republican from Wakefield. "This means there is going to be a debate in this election as to whether or not the last 2 1/2 years the state has been on the right path -- or should we change directions. I think Charlie is the perfect person to explain why we need to change directions."

Patrick welcomed Baker's entry into the race, saying, "I think competition is good. I don't think we have enough."

Baker spent eight years in state government in the Cabinets of Weld and Governor Paul Cellucci. He served first as secretary of health and human services and then as secretary of administration and finance during some of the Big Dig.

Baker flirted with a run for governor four years ago, almost mounting a challenge to then-Lieutenant Governor Kerry Healey for the GOP nomination. Baker announced he would not run at the end of August 2005 because he and his wife, Lauren, decided that a campaign would put an "unfair burden" on their family. They have two teenage sons and a young daughter.

Baker has served one three-year term as selectman in his hometown of Swampscott. He received a bachelor's degree in English from Harvard College and a master’s degree in management, concentrating in public administration and finance, from Northwestern’s Kellogg School.

In the fight for the GOP nomination, Baker will battle Christy Mihos, a convenience store magnate from West Yarmouth. Mihos garnered 7 percent of the vote when he ran for governor as an independent in 2006. Mihos announced in April that he would run.

On Tuesday, the Globe reported that State Treasurer Timothy P. Cahill would leave the Democratic Party this week in what is probably a first step toward an independent gubernatorial candidacy. The news set off a massive scramble as potential candidates for treasurer tried staking a claim on front-runner status.

"The governor never expected to stand for re-election unopposed," Charlotte Golar Richie, executive director of Patrick's re-election committee, said in a statement. "There is plenty of time for the campaign in the future, but we welcome all candidates into the race and look forward to a serious discussion about how we will create new jobs, provide our children with the best education and the other important issues facing Massachusetts."

"Given the troubled times for families and for the Commonwealth, Charlie's breadth of experience in the private sector and in helping manage the state's financials will be extraordinarily helpful," former Governor Mitt Romney said in a statement. "With so many politicians that promise much but deliver little, it will make a real difference for Massachusetts families to have a governor who has actually accomplished so much."

Mihos, who announced in April that he would run in 2010 as a Republican, has hired Dick Morris, a well-known conservative political consultant and commentator who was involved in campaigns for Weld.

Mihos, in an interview this afternoon, characterized Baker as the pick of the party faithful, and someone who is “big business and big government.”

“Lookit, I am not an institutional or an insider Republican,” said Mihos, who is scheduled to speak to the Republican Town Committee tonight in Baker’s hometown, Swampscott. “If that’s what they want, they have Charlie. I’m an outsider, a populist Republican. We’ll let the people see what they want.”

Baker is well known among top political and business circles, but one of his major challenges will be trying to achieve better name recognition.

“A lot of people don’t know him,” said former governor Jane Swift. “He’s got to get out there quickly and define himself before his opponents do. He’s going to have to raise a lot of money and spend a lot of time shaking hands and kissing babies.”

-

-

(John Tlumacki/Boston Globe Staff)

-

-----

-

In 1996, Baker, secretary of administration and finance, listented intently during an afternoon briefing. (Jonathan Wiggs/The Boston Globe/File 1996)

-

"For GOP's Baker, a long resume at a relatively young age"

By Eric Moskowitz, Boston Globe Staff, July 8, 2009

Not yet 50, Charles D. Baker Jr. had built a considerable resume when he first ran for public office in 2004 — the Harvard basketball player who became a think-tank dynamo, served as trusted adviser to two Republican governors, and orchestrated the turnaround of a struggling health plan.

Although Republican operatives envisioned Baker on Beacon Hill, he set his sights closer to home: the Board of Selectmen in Swampscott, population 14,000.

Some colleagues from the Weld and Cellucci administrations tried to discourage him, worried that a loss would dash a future political career. ‘‘He took it all in and heard me out,’’ said Virginia B. Buckingham, a chief of staff to both governors who tried to dissuade Baker. ‘‘Then he said, ‘I’m doing it because I care about my town, and I think I can help my town.’’’

Baker won in a landslide and proceeded to dig into the budget in his North Shore suburb, where his three kids were enrolled in the schools.

It was, friends say, classic Charlie Baker, at once high-achieving and grounded. They describe the newly announced Republican gubernatorial candidate as an exacting policy wonk with charisma; a towering, energized man who pauses to listen patiently; a high-powered executive who showed up for his first Memorial Day ceremony as selectman in T-shirt and shorts, then had to scurry home for a suit.

‘‘Charlie is bigger than life, but exactly the opposite at the same time,’’ said Mindy d’Arbeloff, a Boston marketing executive who has been friends with Baker since childhood.

For as long as d’Arbeloff can remember, Baker is the guy who has explained complex policies to her with simple diagrams on scraps of paper. He is also the avid music fan who occasionally worked as a bouncer at rock shows in his youth and remains unabashed about taking his teenagers to see the Dropkick Murphys.

As a new candidate for governor, Baker, now 52, is unknown to many voters, and he is not without critics on policy. Some service providers used the term ‘‘slash and burn’’ to describe his 1990s efforts, as undersecretary for health and human services, to close state hospitals and rein in costs. But Baker has earned respect on Beacon Hill and in the business community as a smart, measured leader.

‘‘He’s easygoing, but no one should mistake that [he also has] a steely determination to get the right result,’’ said Paul Cellucci, the former lieutenant governor and governor who worked with Baker for much of the 1990s.

Baker grew up in Needham — aside from a stint in Washington, while his father served as a deputy undersecretary of transportation in the Nixon administration — and attended Needham High, where he was a multisport athlete.

The oldest of three boys born to a Republican father and Democrat mother, Baker was a voracious childhood reader and early participant in kitchen-table debates that ran ‘‘hot, heavy, and all the time,’’ said his father, Charles Sr., who also served in the Reagan administration and is now retired from business, government, and education.

‘‘He’s got a great degree of curiosity,’’ Baker’s father said. ‘‘He’s a quick study, but he’s a really serious thinker. A lot of quick studies, they stop right there.’’

At Harvard, Baker concentrated in English, lettered in basketball, and began a Big Brother relationship that he maintained through decades, eventually serving as best man at his Little Brother’s wedding. After earning an MBA at Northwestern’s Kellogg School, where he met his wife, Lauren, Baker worked as a consultant and helped build the Pioneer Institute, a Boston think tank with a libertarian bent.

Baker’s ‘‘best quality is probably his ability to get along with people. And second, he has an excellent mind, and he knows how to channel energy,’’ said Lovett C. Peters, the retired oil man who founded Pioneer, made Baker his second hire, and remains an office regular at age 96.

Peters ultimately recommended Baker to William F. Weld, who consulted Baker broadly on policy issues and asked him to be undersecretary for the Health and Human Services Department after his 1990 election.

But first, Weld arranged for Baker to speak with David P. Forsberg, Weld’s choice for secretary of the agency, to ensure they had chemistry. The resulting conversation was a dizzying call in which Baker peppered Forsberg with questions and wowed him with ideas that would help shape the administration’s plan to cut costs and reorganize public services.

Afterward, Forsberg told his wife, ‘‘I think I’ve just been interviewed to see if I can be somebody’s boss,’’ he recalled yesterday.

By the time Weld left office, Baker had joined his Cabinet, serving first as health and human services secretary and then as secretary for administration and finance, a position he continued under Cellucci. But Baker passed at the opportunity to run as Cellucci’s lieutenant governor, a spot subsequently offered to Jane Swift.

Baker instead left government to become chief executive of Harvard Vanguard Medical Associates, a nonprofit group practice with physicians across Eastern Massachusetts. A year later, in mid-1999, the struggling HMO Harvard Pilgrim Health Care brought Baker in to right an organization that was hemorrhaging money.

After initial bumps, Baker oversaw a turnaround that included more than two dozen consecutive profitable quarters, at the same time the company finished atop the National Committee for Quality Assurance’s ranking of health plans five years in a row.

Even as he ran Harvard Vanguard, served as selectman, kept a healthcare blog, and maintained a steady presence at his children’s sporting events, friends say, Baker nurtured an interest in becoming governor.

‘‘There are still idealistic people in this business who care and think they can help, and that’s why they get in,’’ said Buckingham, now director of public affairs for Pfizer Inc. ‘‘He’s one of them.’’

-

Steve Rosenberg of the Globe staff contributed to this report.

-

-----------

The Boston Globe, Op-Ed, JOAN VENNOCHI

"The challenges for challenger Charlie Baker"

By Joan Vennochi, July 9, 2009

CHARLIE BAKER finally stopped thinking about running for governor. He will run, he announced yesterday.

Baker, the CEO of Harvard Pilgrim HealthCare, is a numbers guy. He doesn’t act on whims. If he’s in, he must think Governor Patrick, the incumbent Democrat, is truly vulnerable.

He must be looking at the 2010 race and thinking back to 1990. Massachusetts, universally disdained as “Taxachusetts,’’ was in deep fiscal trouble. Democratic governor Michael Dukakis, with support from the Democratic leadership of the House and Senate, made the tough call to raise more taxes. Voters decided they wanted the check of a Republican governor against the GOP-framed perception of Democrats gone wild.

But it wasn’t that simple then and it isn’t now.

Republican Bill Weld won an open seat against John Silber, a grouchy, unconventional Democrat who was still leading the race until he imploded during an infamous TV interview shortly before Election Day.

Baker will be challenging a first-term governor who has had a rocky tenure, but can still count on his liberal base. Unless Baker keeps fellow Republican Christy Mihos off the ballot, he must win a primary fight against the convenience chain owner, who already signed on Dick Morris, a nasty and nationally-known political consultant. The general election turns into a three-way race if state Treasurer Timothy Cahill runs, as threatened, as an independent.

A past Cabinet secretary for two Republican governors, Baker is smart and thoughtful. But he’s a virtual unknown to the general public and untested as a candidate for political office. Then again, that makes him a lot like Patrick, who beat an incumbent attorney general and millionaire businessman to become his party’s nominee, and then went on to become the first Democrat in 16 years to win the governor’s office.

Recent poll numbers show that Patrick faces a tough reelection fight. His job approval rating is low. But the election is more than a year away and a Democrat, especially in a three-way race, holds an important advantage in Massachusetts.

Baker’s tenure at Harvard Pilgrim will be scrutinized. He also should have to answer for decisions made during the Weld-Cellucci era. Weld, especially, promised leaner, more streamlined government. His pledge was mostly a euphemism for drastic cuts in social services.

Baker said he wants to be governor so he can tackle the state’s fiscal challenges “and bring ideas, energy, and leadership to the tasks that face state government in the years ahead.’’ Yet when Baker was secretary of administration and finance, the state borrowed billions against future federal highway aid to underwrite ever-ballooning Big Dig costs. Taxpayers are still paying that tab.

Baker was secretary of health and human services when the Weld administration moved to deregulate the healthcare industry in Massachusetts. Healthcare providers now compete with one another; the state no longer sets rates. Massachusetts residents are paying for that, too.

Voters may simply consider such decisions ancient history, or conclude a governor, not a Cabinet secretary, is accountable for them. Either way, Baker is an impressive opponent. He can run as an antidote to Patrick’s poetry and undelivered promise to lower property taxes. He can run as a cool-headed agent of post-partisan politics - Barack Obama without the rhetorical flourish and compelling personal story. If the economy is as bad as it is now, or worse, it will be even harder for Patrick to weave a narrative for reelection. In the meantime, Baker has a lot of credibility in the Massachusetts business community. That could help him with fund-raising, and undercut Patrick’s ability.

Yet winning election requires more than money, as any number of failed millionaires demonstrates. It’s about connecting with people in a personal way, convincing voters to trust you with important aspects of their lives and children’s future. It’s about selling a vision of government to a disparate population. Is that vision strictly business? Is there room for compassion, not to mention state-funded programs for the vulnerable?

With Baker in, this will be a fascinating election, with serious candidates debating substantive issues - or so we can all hope.

-

Joan Vennochi can be reached at vennochi@globe.com.

-

-----------

"Race for governor begins"

The Berkshire Eagle, Editorials, Friday, July 10, 2009

While it could be argued that it is always campaign season at the state and federal level, the 2010 Massachusetts governor's race officially began Wednesday when Charles Baker announced that he would challenge Governor Deval L. Patrick next year. If Treasurer Tim Cahill decides to run for governor as an independent, as seems likely, the race could be fascinating and difficult to predict.

Mr. Baker will step aside as CEO of Harvard Pilgrim Health Care to run for the state's top office, pleasing Republicans who had hoped he would challenge unimposing Lieutenant Governor Kerry Healey for the GOP gubernatorial nomination last time around. A former top aide in the administrations of Governors William Weld and Paul Cellucci, Mr. Baker is well-regarded for his business acumen, in large part for his efforts in rescuing Harvard Pilgrim from insolvency and keeping the nonprofit financially sound.

As secretary of health and human services, Mr. Baker was instrumental in health care deregulation that was of more apparent benefit to health care organizations than the general populace. Later, as secretary of administration and finance, he was one of the early proponents of the financial fiasco that was the Big Dig. While Mr. Baker is regarded as a fiscal conservative and social liberal, the typical formula for successful Massachusetts Republicans (Weld was both, Mitt Romney pretended to be the latter), the Big Dig may weaken his financial credentials.

The politically ambitious Mr. Cahill apparently saw his road blocked by Governor Patrick, and Wednesday he set up a run for governor by switching his party registration from Democrat to unenrolled. The only state office-holder not chosen as a delegate to the most recent Democratic convention, Mr. Cahill is not popular with his former party's liberal wing and will be seeking the same fiscal conservative banner as will Mr. Baker and Christy Mihos, the wealthy businessman making his second bid for the Republican nomination. Independents rarely win major office, and Mr. Cahill will be a long shot.

Many of Governor Patrick's ambitious plans were sacrificed to the bad economy, and voters may go into 2010 fed up in general with Beacon Hill. However, if Mr. Baker and Mr. Mihos run against the "tax and spend" Democrats, they may find it is not the ‘90s anymore, when the nickname "Taxachusetts" was a better fit than it is today. Whatever the strategy of the GOP, and Mr. Cahill, the race is under way.

-

www.topix.net/forum/source/berkshire-eagle/TT9V39IP067H3LHDO

-

-----------

-

-

Charles Baker said he will leave his post at Harvard Pilgrim Health Care to run for governor of Massachusetts. (Steven Senne/Associated Press)

-

"Role in financing Big Dig may test Baker’s campaign"

By Noah Bierman, Boston Globe Staff, July 17, 2009

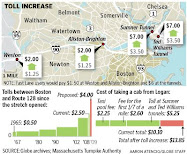

When the Big Dig was short on cash in the mid-1990s, state officials made a decision that is still affecting the quality of roads, bridges, and highway finances today.

In exchange for $1.5 billion upfront, the state pledged to surrender to bondholders more than a quarter of its federal highway grants from 2006 through 2015, about $150 million per year.

Governor Paul Cellucci’s top financial adviser when the program was conceived and passed into law was Charles D. Baker, who announced last week that he is running for governor.

At the time, Baker defended a plan to increase short-term borrowing as a way to save money over the long term, by getting as much work done as possible before the cost of labor and materials went up.

“The thing that really drives up costs is inflation,’’ he told the Globe in 1997.

Now that Baker has reentered the political arena at the state’s highest level, his decisions as the state secretary of administration and finance from November 1994 through September 1998 and the impact they still have on state government will provide a significant test of the Republican’s ability to pitch himself as a fiscal conservative against primary opponents and, potentially, Treasurer Timothy P. Cahill, an independent, and Governor Deval Patrick, a Democrat.

His reputation as a strategic player inside the administrations of governors William F. Weld and Cellucci could also grow more complicated if he attempts to distance himself from some of their more controversial actions.

“If you are paying with tomorrow’s dollars to build something you can’t afford today, it’s inevitable that sooner or later the financial structure is going to implode,’’ said Senator Mark C. Montigny, a New Bedford Democrat who voted for elements of the Big Dig financing structure, but later became a vocal critic.

Baker declined several requests to speak about his role in financing the Big Dig, stating in an e-mail and through a spokesman that he is in a transition period, leaving his job as chief executive of Harvard Pilgrim Health Care, and will not be an official candidate until the end of the month.

He referred inquiries to a spokesman, Rob Gray, who could not answer specific questions about Baker’s thought processes at the time or speak in depth about Baker’s involvement in key decisions. Gray said Baker had a “limited role in the financing process’’ of the Big Dig and that, as administration and finance secretary, he “had no control over management of the Central Artery/tunnel project.’’

Gray said Baker left state government before “peak construction and the revelation of cost overruns by the Turnpike Authority, an independent agency’’ that managed the project.

It is true that the project’s most startling cost overruns, a hidden $1.4 billion, were revealed in 2000, after Baker stepped down as secretary. But the first of the project’s three peak spending years began in 1998, before Baker left, when costs reached $4 million a day. And the overall projected price tag had already reached $10.8 billion by the time he left. It would eventually reach $15 billion.

And the decision to assign the project, and much of its debt, to the Turnpike Authority in two bills passed in 1995 and 1997, was also crafted during Baker’s time as a top finance man on Beacon Hill. In 1997, when critics were cautioning that the state was not setting aside enough money to pay for the Big Dig, he defended the turnpike plan as “the right mechanism for dealing with a situation that everyone admits is going to be challenging.’’

Since then, the Turnpike Authority’s role has been attacked by Big Dig critics, who have complained that the authority, which has an unelected board, was not directly accountable to the public for cost overruns and that commuters on the turnpike were forced to pay an undue share of Big Dig debt through tolls.

That debate is still being fought on Beacon Hill, where an overhaul of the transportation system was recently passed, eliminating the Turnpike Authority as of November, though not the $2.4 billion debt it carries, largely courtesy of the Big Dig.

Former House Transportation Committee chairman Joseph C. Sullivan, who led the panel when many financing decisions were made, said Baker had a heavy hand in the plan to assign Big Dig expenses to the Turnpike Authority.

“The primary author was the governor and, instrumental in that authorship, was Secretary Baker,’’ said Sullivan, a Democrat and now mayor of Braintree.

Sullivan, who helped pass the most significant piece of the plan in 1997, praised Baker as smart and competent and pointed out the economic and political dynamics at the time: Big Dig costs were climbing. The federal government’s promise to shoulder the burden was dwindling. And state officials at all levels were scrambling to define costs and explain how they could be paid. There was intense pressure to develop a financing plan.

“He had a role to play, but the major decisions were not made at his level, in other words, the decision to move forward and to build this project,’’ said Cellucci. “Once the governor says ‘This is what we’re going to do,’ it’s the responsibility of the secretary of administration and finance to do it.’’

Although it was clear the state did not have the money for its share, there was no political will to raise taxes. The state was running out of places to borrow money, so it hatched a plan akin to a debtor who agrees to have future wages garnisheed to pay urgent bills.

“We already were so heavily borrowing, the state, through the normal processes of borrowing,’’ said Michael J. Widmer, president of the Massachusetts Taxpayers Foundation. “And in this case, the price, I would argue, is high . . . almost a decade of sacrificing a third of our highway money.’’

In addition to an average of $150 million a year that gets taken out of statewide highway and bridge grants, Massachusetts pays an average of $60 million a year in interest out of the state Treasury.

Yet even as the original plan was taking shape, Baker told legislators in 1998 that regional projects would not be hurt. “I don’t see how anybody could argue that the artery will be pulling money away from non-artery projects.’’

The debts taken out at the time have made it harder for the Patrick administration to pay for bridge repairs that engineers say are desperately needed.

So Patrick has settled on the same solution. As part of his own $3 billion bridge repair program, Patrick is borrowing $1.1 billion from future federal grants, agreeing to make payments between 2015 and 2021, when the Cellucci loans are paid off.

Patrick has made the same argument Baker made, that it saves money to spend money now, before inflation and wear and tear make repairs more expensive.

And Widmer and other fiscal watchdogs are making similar criticisms, that borrowing into the future will extend the state’s cycle of poverty.

None of the earlier decisions were Baker’s alone, of course. Key members of the Legislature, Weld and Cellucci and their staffs, and, significantly, former transportation secretary James J. Kerasiotes, and the Turnpike Authority all weighed in. Patrick’s transportation secretary, James A. Aloisi Jr., a former general counsel for the Turnpike Authority, drafted the actual legislation that put the turnpike in charge of the Big Dig.

But Montigny, who was not in leadership at the time but has since controlled key financial committees, said those decisions could not have been made without significant input from the state’s top finance adviser.

“It would be impossible to get that kind of a monster created without the [administration and finance] secretary, the governor, and the legislative leadership,’’ he said. “It’s just too big of an undertaking.’’

-----------

"Gubernatorial hopeful Baker filing papers Wednesday"

By Associated Press, Sunday, July 26, 2009, www.bostonherald.com - Local Politics

Charles Baker is officially leaving the business world behind for politics.

The former Harvard Pilgrim Health Care president is filing papers Wednesday to enter the 2010 Massachusetts gubernatorial race as a Republican.

The move comes as Democratic Gov. Deval Patrick sees his stock ebb in polls amid the state’s recession and a 25-percent sales tax increase slated to take effect next Saturday.

After years of speculation about whether he might run for governor or U.S. Senate, Baker is taking the plunge with a round of media interviews on Tuesday and the paperwork filing on Wednesday.

The former Weld administration aide then heads to a Boston law firm for his first fundraiser.

Convenience store owner Christy Mihos is also seeking the GOP nomination.

-----------

"Baker: Dems Made Mass. Crisis 'A Calamity': Republican Kicks Off Campaign"

www.thebostonchannel.com/politics - 7/28/2009

BOSTON -- Republican Charles Baker kicked off his gubernatorial campaign Tuesday by saying Gov. Deval Patrick and Beacon Hill Democrats have "turned a crisis into a calamity" and made the Massachusetts economy "a wreck" with excessive government spending and an unwise sales tax increase.

In a video to supporters on his new Web site, the former Harvard Pilgrim Health Care president said he is worthy of being elected governor next year because he has twice engineered economic turnarounds.

The first came in the 1990s when he served as finance chief in the Weld and Cellucci administrations; the second came during the past 10 years, as he turned Harvard Pilgrim from the verge of bankruptcy into one of the nation's leading health insurers, he said.

"When it comes to change, I am two things: fearless and determined," he said. "And as your governor, I will be both."

The video shows Baker in a dungaree shirt, gesticulating with his hands as he stands against a park backdrop. It actually was produced by having him stand indoors in front of a green screen and then superimposing the scenery behind him.

In it, he says: "The Massachusetts economy is a wreck right now." Lamenting empty store fronts, home "For Sale" signs, lost jobs and a 25 percent sales tax increase taking effect Saturday, Baker adds: "Massachusetts is on the wrong track, and Beacon Hill has no idea how to fix it. In fact, they're making it worse. They've turned a crisis into a calamity."

A Patrick campaign spokesman did not immediately respond to a request for comment, but on Monday, the governor defended his leadership in the face of sagging polls.

He said he has been focused on the state's long-term interests and insisted governmental reforms accompany the tax increase he signed into law. Such reforms, he said, had eluded some of his Republican predecessors.

The Democrat took office in January 2007 after a 16-year GOP run in the Corner Office that began with Baker's former boss, William F. Weld.

"Campaigns are about explaining what we've done and, more importantly, where we're going," Patrick said. "And we'll have an opportunity in the campaign to do just that, and the people will have an opportunity to choose whether they want to go forward or go backward."

Baker, a 52-year old from Swampscott, officially enters the race Wednesday when he files his candidacy declaration with the state Office of Campaign and Political Finance. He then has a schedule of activities, including organizational meetings, fundraisers and a speech Thursday to the Cape Cod Chamber of Commerce.

The video appears on his new Web site, www.charliebaker2010.com.

Convenience store owner Christy Mihos also is seeking the Republican nomination. Treasurer Timothy Cahill is mulling an independent candidacy.

-----------

"Baker: Massachusetts Democrats have turned crisis to ’calamity’"

By Associated Press, Tuesday, July 28, 2009, www.bostonherald.com - Local Politics

Republican Charles Baker kicked off his gubernatorial campaign today by saying Gov. Deval Patrick and Beacon Hill Democrats have "turned a crisis into a calamity" and made the Massachusetts economy "a wreck" with excessive government spending and an unwise sales tax increase.

Surrogates for the incumbent immediately struck back by branding his opponent "Big Dig Baker."

In a video to supporters on his new Web site, Baker said he is worthy of being elected governor next year because he has twice engineered economic turnarounds.

The first came in the 1990s when he served as finance chief in the Weld and Cellucci administrations, he said. The second came during the past 10 years when, as president of Harvard Pilgrim Health Care, he turned the company from the verge of bankruptcy into one of the nation’s leading health insurers.

"When it comes to change, I am two things: fearless and determined," he said. "And as your governor, I will be both."

The video shows Baker in a dungaree shirt, gesticulating with his hands as he stands against a park backdrop. It actually was produced by having him stand indoors in front of a green screen and then superimposing the scenery behind him.

In it, he says: "The Massachusetts economy is a wreck right now." Lamenting empty store fronts, home "For Sale" signs, lost jobs and a 25 percent sales tax increase taking effect Saturday, Baker adds: "Massachusetts is on the wrong track, and Beacon Hill has no idea how to fix it. In fact, they’re making it worse. They’ve turned a crisis into a calamity."

The Massachusetts Democratic Party, controlled by Patrick and run by his 2006 campaign manager, John Walsh, immediately launched a Web site accusing Baker of allowing the $15 billion Big Dig project to escalate in price during the 1990s.

The site - www.bigdigbaker.com - asks five questions, including why his campaign advisers insisted he had a "limited role" in the highway project when, at the time, he was the state’s finance chief and authored a project financing plan. Baker had refused to respond to such inquiries before he had resigned from Harvard Pilgrim at mid-month or taken a previously scheduled family vacation.

"When a news report last week detailed Republican Charles Baker’s prominent role in decisions about financing the Big Dig, several questions were raised, but he still refuses to answer them," Walsh said in a companion statement released by the Democratic Party.

On Monday, the governor defended his leadership in the face of sagging polls. He said he has been focused on the state’s long-term interests and insisted governmental reforms accompany the tax increase he signed into law. Such reforms, he said, had eluded some of his Republican predecessors.

The Democrat took office in January 2007 after a 16-year GOP run in the Corner Office that began with Baker’s former boss, William F. Weld.

"Campaigns are about explaining what we’ve done and, more importantly, where we’re going," Patrick said. "And we’ll have an opportunity in the campaign to do just that, and the people will have an opportunity to choose whether they want to go forward or go backward."

Baker, a 52-year old from Swampscott, officially enters the race Wednesday when he files his candidacy declaration with the state Office of Campaign and Political Finance. He then has a schedule of activities, including organizational meetings, fundraisers and a speech Thursday to the Cape Cod Chamber of Commerce.

The video appears on his new Web site, www.charliebaker2010.com

Convenience store owner Christy Mihos also is seeking the Republican nomination. Treasurer Timothy Cahill is mulling an independent candidacy.

-----------

-

-

Photo by Ted Fitzgerald

-

"Baker: No new taxes if elected governor in 2010"

By Hillary Chabot, Wednesday, July 29, 2009, www.bostonherald.com - Local Politics

Gubernatorial hopeful Charlie Baker vowed to roll back the 25 percent sales tax hike as he kicked off the 2010 race this morning, brandishing a “no new taxes,” mantra that some GOP candidates have come to regret.

“Read my lips, ‘No new taxes,’ ” said Baker, brushing off the criticism that the slogan sunk former Republican President George H. W. Bush. “I remember (former Gov. William Weld) said it too, and he meant it.”

Murray also took some shots at Gov. Deval Patrick, saying the governor let the budget, “get away from him.”

“I wouldn’t have traded modest pension reform, modest ethics reform and modest transportation reform for (an increase) in the sales tax in the middle of the worst recession we’ve had in my life time,” said Baker.

Lt. Gov. Tim Murray, once again taking up the mantle as Patrick’s attack dog, hit back by tying Baker, who worked as secretary of administration and finance under former Gov. William Weld, to the Big Dig and questioning his work with Harvard Pilgrim.

“If you’re a fan of higher insurance premiums, you’ll like Charlie Baker, and if you’re a fan of the Big Dig financing and record debt, you’ll love Charlie Baker,” Murray said in a statement.

Baker, who appears to be fashioning himself after Weld, filed his campaign finance information this morning will officially announce his candidacy in September. Baker said he supports abortion rights and gay marriage but he also backs the death penalty.

Weld declined to speculate on a running mate, or discuss the campaigns of fellow GOP candidate Christy Mihos or potential unenrolled challenger Treasurer Tim Cahill.

“I haven’t ruled anything in or out at this time,” said Baker.

-----------

"The money debate starts now"

A BOSTON GLOBE EDITORIAL - August 2, 2009

FOR STATE VOTERS starved for a robust debate on pocketbook issues, Wednesday was a red-letter day. That was when former Harvard Pilgrim Health Care CEO Charlie Baker officially joined the race for governor in 2010. His entrance ensures a Republican primary contest with former Massachusetts Turnpike Authority board member Christy Mihos. If Baker wins that, he would likely face incumbent Democrat Deval Patrick and, possibly, Treasurer Timothy Cahill running as an independent. As long as Baker is in the race, voters have a right to expect from him solid numbers on how to fix state government, and not the specifics-free boilerplate about reducing waste, fraud, and abuse that many candidates stoop to.

Baker’s special credential for the race is the other important “former’’ in his past - he was secretary of administration and finance under Governor William Weld. That means he has a working knowledge of the ins and outs of the state budget. Baker helped Weld steer the state out of red ink caused by another recession. The two got assistance from tax increases passed by the Legislature before Weld took office.

In this recession, too, the governor and Legislature have resorted to tax increases - principally a hike in the sales tax from 5 to 6.25 percent - to balance the budget. Baker has said he would move to repeal that increase. An early challenge for him will be to explain what cuts he would propose to make up for the $900 million of annual new revenues provided by the increase.

So far, Baker has implied he might invoke a hiring freeze, without an estimate of what that would save. Beyond that, he has said everything would be on the table, including cuts in the state’s program of universal health insurance. Between Medicaid, the state-subsidized Commonwealth Care program, and state employees’ own insurance, healthcare makes up so much of the budget that major cuts in state spending are almost sure to affect some residents’ health. Indeed, legislators have already taken back more than half the money that would have gone toward insuring legal immigrants.

What other benefits would Baker rescind? Would he make additional cuts in state support for the safety-net hospitals, even though the biggest of them, Boston Medical Center, has already taken the state to court for aid it believes it is owed? The Massachusetts Taxpayers Foundation says health reform adds just $88 million a year to the state budget. Would Baker cut into benefits residents were receiving before reform?

In difficult times, voters are looking for specific solutions. Fortunately, Baker’s extensive background in both health insurance and government leaves him - and his rivals - no choice but to speak frankly about the state’s grim finances.

-----------

The Boston Globe, Op-Ed, JOAN VENNOCHI

"Reading Baker’s lips on taxes"

By Joan Vennochi, Boston Globe Columnist, August 2, 2009

READ MY LIPS. No new taxes.

Is George H.W. Bush’s broken promise of 1988 really the best campaign slogan for Republican gubernatorial candidate Charlie Baker?

Last week, Baker officially entered the 2010 race to become governor of Massachusetts. Quickly, Andy Hiller, a veteran TV political reporter who knows how to get his sound-bite, goaded the newly minted GOP candidate into repeating the words that helped make the elder Bush a one-term president. “Yeah,’’ said Baker. “Read my lips. No new taxes.’’

What’s next? A “lead-pipe guarantee’’? Oops, that was a Democrat. Governor Michael Dukakis said that back in the ’70s, and paid the price.

Baker was once dubbed “the smartest man in state government.’’ It may be brilliant strategy to wrap yourself in the words a leading Republican pollster ultimately called “the six most destructive words in the history of presidential politics.’’ But, I have my doubts.

Running on a no-new-taxes platform is the obvious play for Baker, the former chief executive of Harvard Pilgrim Health Care. He is counting on the same kind of backlash that drove Massachusetts to elect Republican Bill Weld as governor back in 1990.

Baker held high-profile policy positions for Weld, and then for Weld’s successor, Paul Cellucci. He will try to win the governor’s office by making the same case as Weld: that a socially moderate, fiscally conservative Republican governor is the voters’ best hope against a state run by tax-and-spend Democrats.

He is helped by an economy that is currently working against the Democratic incumbent. Faced with a national recession and declining state revenues, Governor Deval Patrick is presiding over unpleasant budget cuts and unpopular tax increases. This weekend, the Massachusetts sales tax increased from 5 percent to 6.25 percent. Baker, of course, is pledging to repeal it. Recent polling shows voters are unhappy with Patrick’s handling of the economy. For now, Patrick is unpopular and looks vulnerable.

Even so, is it wise to launch the campaign against him on a rhetorical flourish that is now equated with political defeat?

Bush made the pledge more than 20 years ago. When he raised taxes to reduce the national budget deficit, the reversal allowed Democrat Bill Clinton to question his trustworthiness.

So many politicians have broken so many promises since. It is hard to believe voters still accept any at face value, especially a promise that turned into a political punch line. But many voters want to believe in the sanctity of a candidate’s vows, just as many ex-couples still want to believe in true romance. When voters and lovers get burned, they are disappointed, to say the least.

When he ran for governor, Patrick floated a lot of pretty-sounding promises involving hope and change. He made a specific promise to lower property taxes and a broad promise to deliver on a different kind of politics. For a variety of reasons, including the economy and an entrenched political establishment, making good on them is tough. It may not be fair to blame Patrick for forces beyond his control, but recent polling shows that’s what voters are doing, at least for now.

So, the last thing any smart challenger should do is over-promise. Because that’s exactly what Patrick did. He set expectations so high, falling short was always a threat. In the midst of a recession, it was inevitable.

In light of voter disenchantment with the political model Patrick represents, a successful challenger should think about the antidote. Prose, not poetry. Realistic goals instead of broken promises like “Read my lips. No new taxes.’’

Bush made the promise because he wanted to win. And win he did - once. If Baker wins, and faces a revenue gap, he will do what Republican governors always do in Massachusetts: look to a Legislature controlled by Democrats to solve the problem, and then blame them for solving it.

If elected, Baker said that he will try to repeal the sales tax increase - just as Weld said he would try to roll back the state income tax. To Weld’s relief, that never happened, despite his alleged commitment to the cause. Mitt Romney, the state’s last Republican governor, kept his no-tax pledge by raising millions in fees.

Read my lips. Baker knows the truth, even if he won’t admit it.

-

Joan Vennochi can be reached at vennochi@globe.com.

-

-----------

-

-

ACE IN THE HOLE: Ex-Red Sox hurler Curt Schilling is throwing his support behind GOP gubernatorial contender Charlie Baker. The politically minded Schilling is shown meeting with Sen. John Kerry in Washington. (Photo by John Drew)

-

"Curt Schilling’s pitch: Vote Charlie Baker"

-

-

By Jessica Fargen / Pols & Politics - The Boston Herald Online, Sunday, August 2, 2009

-

Retired Red Sox [team stats] pitcher Curt Schilling [stats] has thrown his weight behind GOP gubernatorial wannabe Charlie Baker, according to a post Tuesday on his blog, 38 Pitches.

The Medfield Republican and former Sox ace previously campaigned for Red State men President George W. Bush and Sen. John McCain.

Admittedly, Schilling hasn’t yet done his “homework” on the conservative candidate.

That doesn’t matter.

“I’ve known Charlie for about five years now, and I’ll state right up front I have not dug into his policies or his agenda,” Schilling wrote of Baker, calling the candidate a “man of integrity” and a “man of his word.”

He added: “I’ll vote for him. I’ll vote for him because he’s someone that has always appealed to me as being out for the greater good above all else. This state is in dire need of exactly that right now.”

Ouch.

-----------

-

-

-

Charles Baker (The Boston Herald; Photos by Stuart Cahill) August 2, 2009

-

EYE ON THE STATE HOUSE: While downplaying Gov. Bill Weld’s ‘walrus list,’ Republican gubernatorial candidate Charles Baker says he will require his state employees to be qualified ‘based on their skill set and experience.

-

"Charles Baker defends Bill Weld’s recipe: Gubernatorial hopeful won’t rule out hack hires"

-

-

By Hillary Chabot, Saturday, August 1, 2009 - www.bostonherald.com - Local Politics

GOP gubernatorial candidate Charles D. Baker refused to take an anti-patronage pledge yesterday even as he wraps himself in his mentor William F. Weld’s reform image and defended the former governor’s use of a “walrus” list of campaign backers in state hiring.

“It’s hard to draw a really bright line in the sand on that because, you know, everybody’s definition of that might be different,” Baker said in an exclusive sit-down with the Herald. “I’d rather have the right person for the right job, and I care more about that than how they got there.”

When asked if he would condemn Weld’s so-called “walrus list,” which was a roster of job candidates prioritized by legislative sponsors, Weld supporters and their relatives, Baker downplayed the practice.

“When I look at my own experience with the Weld administration, we appointed a lot of different people to a lot of different roles,” said Baker, who was Weld’s administration and finance secretary. “I don’t recall (the walrus list) having a particularly significant influence on our ability to put the right person in the right job.”

Weld, whom Baker credits with teaching him “about government and politics,” railed against patronage during his first run for governor in 1990 and promised to rid government of political “walruses,” using the basking tusked sea animal as the symbol of a hack.

But Weld went on to pack state branches with pals and political supporters - so many that those hired referred to themselves as the walrus club. His personnel office tracked job applicants based on political activity and even contributions, a practice of which Weld said he was unaware.

Baker’s stance comes on the heels of Gov. Deval Patrick’s recent patronage scandal, where Patrick offered a $175,000-a-year job to early supporter Sen. Marian Walsh. Public outrage prompted Walsh, a West Roxbury Democrat, to turn down the position, which had been vacant for a dozen years.

The 52-year-old Baker, former CEO of insurance giant Harvard Pilgrim Health Care, said he will require his state employees to be qualified “based on their skill set and experience.”

Baker blasted Patrick for hiring 7,500 employees despite a brutal fiscal free fall and said personnel cuts would be one of his first actions if elected.

“It’s like state government is doing business as usual at (a) time when everybody else is working overtime to figure out how to solve their problems,” said Baker, of Swampscott.

During his Herald interview, Baker also:

• Opposed Patrick’s plan to legalize three resort casinos in Massachusetts, saying the resorts would “cannibalize each other.” Baker said he is open to some sort of expanded gaming, however.

• Defended his $1.6 million salary at Harvard Pilgrim while Bay State residents struggle to make health care payments. He argued he helped maintain competitive pricing by turning around the floundering agency.

• Supported using flagmen instead of police details on road work projects, but said Patrick should have pushed for a lower wage to ensure savings.

-----------

"State House Weekly Roundup: Straight to the face"

By Jim O'Sullivan / State House News Service - wickedlocal.com/swampscott/news - Saturday, August 1, 2009

Boston - For his 53rd birthday on Friday, July 31, 2009, Gov. Deval Patrick got a pie.

Technically, Sen. Steven Baddour, Democrat of Methuen, was on the receiving end of the delicious-looking cream pie from Mann Orchards, when FOX25 “Morning News” co-host V.B. strong-armed the confection right into Baddour’s grill, getting some in the hair, which nonetheless did not budge.

“Baddour got it! Baddour got it!” crowed V.B.

The pieing must have been for the birthday-boy governor a pleasant end to a tough week. It started with his crummy poll numbers (36 percent favorability rating) becoming national news as part of a trend for Democratic chief executives. The week also featured the popularization of the term “Bakercrat,” a term that aptly describes Baddour.

A Bakercrat is defined as a member of a small and largely anonymous division of Patrick’s party that was emboldened this week when Senate President Therese Murray, also a Democrat, noncommittally asserted and then re-asserted her party affiliation Wednesday when asked whether she would back the governor’s re-election. “I think he’s the only Democrat running,” she enthused.

The Bakercrats are fans of Swampscott’s own Charles Baker, the recently departed CEO of Harvard Pilgrim Health Care widely seen as the most substantial threat to Patrick in 2010, when Republican Christy Mihos will also be running and when unenrolled Treasurer Timothy Cahill is also expected to join the fray.

Baker made it official this week, and promptly positioned himself as a no-new-taxes, lower-current-taxes, pro-choice, gay-marriage-lovin’, death-penalty-supportin’, straight-talkin’ campaigner who is not afraid to walk into Capitol Coffee on Bowdoin Street and right over to a couple Democratic incumbent legislators, at least one of whom looked positively mortified that the television cameras outside might catch him on B-roll and identify him as a Bakercrat.

“He asked how my brother who has a full head of hair could actually be my brother,” said Sen. Ben Downing, the Pittsfield Democrat known as “the Benator” and who is bald. Downing said Friday that Baker queried Rep. Daniel Bosley about the timing of the gambling debate. Fall.

Democrats and Mihos (Mihocrats?) countered by framing Baker – “Charlie” on the lawn signs in Methuen and in Plymouth – as a Big Dig bogeyman who while he was in state government deregulated the health care industry, then left state government and made a bunch of money while presiding over a health care company that partook in soaring premiums that have hamstrung business growth, which happens to be a big Baker talking point.

The wonderful thing was that the 2010 campaign wasn’t even close to the dust-up that was snippiest and least productive to the actual governing wing of Beacon Hill. That was the to-the-death cage match between Transportation Secretary James Aloisi, a former Baker colleague, and MBTA General Manager Daniel Grabauskas, a former Baker colleague.

The Patrick administration has made something of a cottage industry of forcing out high-ranking officials they find unsuitable or distasteful – the Wallace-Benjamin/Festa/Petersen/Cohen/Tocco dynamic. Grabauskas would certainly be the largest buck to be bagged. When you boss the T, you have an unimaginably fertile drawer of favors to dispense and Grabauskas is a savvy infighter who after Aloisi turned up the temperature this week deployed his own band of supporters, among them Boston Mayor Thomas Menino, a politician unaccustomed to losing personal political battles in which he chooses to engage.

Still, even if Grabauskas does end up getting (sorry) railroaded, former Gov. Mitt Romney will still hold the title, boasting the heads of both Bill Bulger and Matt Amorello on the wall.

Oh, and there was some actual governing and lawmaking that went on. As an $80 million spending bill trundled along, legislation that tried to undo some gubernatorial vetoes, the Senate president said revenues for July could come in as much as $35 million off the mark and said there would be “even more drastic cuts” if the hard rain keeps falling.

Capitol veterans were befuddled by the Legislature’s circumvention of state budget rules by reversing about $80 million of Patrick’s budget vetoes through a supplementary budget rather than taking individual override votes on spending decisions, the way it’s historically been done.

The notion of adding spending, in any form, as tax collections continued to sag was troubling to Republicans and scattered Democrats. Lined up with the half-funded zoos and quarter-funded legal immigrant health care program were elders’ health insurance, probation and court and jails, and beach preservation.

House leaders gave vague reasons – “flexibility” – for taking this route, then made the appropriations bill available to the rank and file two hours before the debate started, which is how things have been done here for a long time and/but which had been promised to change under the new regime.

The frenzied Wednesday night (July 29) essential completion of the legislative calendar for the summer came on the heels of an odd session the previous day when House leadership, complying with Senate will, had to do some fast triage on their language override of Patrick’s resistance to forcing inmate medication programs into the state pharmacy.

And it was curtains for the Legislature until September, when the docket reemerges littered with casinos, charter schools, maybe some criminal justice issues, and changes to the health care payment structure. All of which will manifest themselves through the increasingly clouded and crystal-clear 2010 prism.

Story of the week

The close of business for the summer, legislatively speaking, was Dems on Dems, GOP on GOP, and prominent transportation official on prominent transportation official.

Comical installment of patrick cabinet looking to get new jobs of the week

The Globe reported Friday that Patrick’s labor and workforce development chief got all uppity with Auditor Joseph DeNucci recently and told him she wanted his job.

DeNucci, who was elected auditor during the Hancock administration after an extended career in the House of Representatives, has steadfastly maintained he’s running in 2010, but the rumors of his departure have continued, tempting other political heavies. Worcester Sheriff Guy Glodis, for one, has ruled out a challenge to DeNucci.

Good News

There’s no such thing as Major League Baseball taking away the 2004 and 2007 World Series wins. Despite the drop-off in economic activity last quarter, the University of Massachusetts found a slowdown in the contraction, pinpointing the state’s pace of business “at or near” its bottoming, which Professor Clyde Barrow said would likely occur before the end of the year. A “growth recession” is still a recession, but employment growth in 2010 would likely be good for a lot of people, among them the governor.

-----------

Malden, Melrose

"Tisei named Baker's campaign chairman"

Boston.com - August 3, 2009

-

-

Richard R. Tisei

-

The following is a news release from state Senator Richard R. Tisei, who represents Malden and Melrose:

BOSTON - Senate Minority Leader Richard R. Tisei has been selected to play a key role in Charlie Baker’s upcoming campaign for Governor of Massachusetts.

Baker, who recently stepped down from his post as CEO of Harvard Pilgrim Health Care to enter the 2010 gubernatorial race, has asked Tisei to serve as his campaign chairman. In this capacity, Tisei will be one of the key players responsible for honing Baker’s message to the state’s voters as he seeks to unseat Democrat Deval Patrick.

“I am really pleased to have Richard on my team. He helped Bill Weld get elected and then straighten out the budget and stop new taxes in the early 1990's, and that kind of know-how will help me immensely,” said Baker. “He's a good friend and someone I will look to for sage advice and support.”

Tisei, who previously served as campaign chairman for William Weld’s successful run for the Corner Office in 1990, said he is “honored” to join Baker’s campaign team and is “looking forward to helping the voters become acquainted with Charlie Baker and his message of change.”

“Charlie Baker brings a lot to the table,” said Tisei. “As a former Secretary of Health and Human Services and Administration & Finance, he knows the inner workings of state government and the budget process, and understands just how important the art of compromise is for making progress and getting things done. He also has experience in the private sector, so he is well aware of how the decisions made on Beacon Hill can directly impact taxpayers and businesses.

“Charlie had a proven track record of strong leadership at Harvard Pilgrim, which he helped to turn around and transform into one of the state’s most successful and profitable health care insurers,” Tisei added. “Now he is ready to take on the challenge of governing the Commonwealth during these tough economic times. As governor, Charlie will be ready from day one to hit the ground running and help steer the Commonwealth back on a steady course of economic growth and jobs creation.”

Tisei, 46, was first elected to the Massachusetts House of Representatives in 1984, at the age of 22. He served three terms as a state Representative for the towns of Lynnfield and Wakefield from 1985 to 1991.

Tisei is currently serving his tenth term as state Senator for the Middlesex and Essex District, which is comprised of the cities of Malden and Melrose and the towns of Lynnfield, Reading, Stoneham and Wakefield. He was elected as the Minority Leader of the Massachusetts State Senate in January of 2007.

To learn more about Charlie Baker’s campaign for governor, visit his official campaign website at www.charliebaker2010.com.

-----------

-

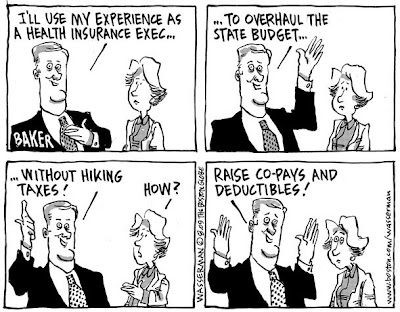

"Charlie Baker's budget"

Boston.com - My Daily Work: Posted by Dan Wasserman, The Boston Globe, August 4, 2009

-

-

-----------

-

-

Gubernatorial candidate Charles D. Baker Jr. cites his role in rescuing Harvard Pilgrim. (Lane Turner/Globe Staff/File 2005)

-

-

"State aided Baker’s business triumph: Harvard Pilgrim a key credential"

By Megan Woolhouse, Boston Globe Staff, August 5, 2009

Former Attorney General Thomas F. Reilly and Charles D. Baker Jr. were not natural allies.

Reilly, a lifelong Democrat, and Baker, a devout Republican, met in January 2000 as Harvard Pilgrim Health Care teetered on the edge of financial ruin. Baker, the company’s new chief executive, had just told the state of a $58.5 million accounting error that pushed the company’s losses to a dangerous $227 million.

The mistake, which became known as the “January surprise,’’ shook the New England healthcare industry. A collapse of the state’s second-largest health insurer would have left 1.3 million patients scrambling for coverage, and shortchanged hospitals and doctors across Massachusetts and beyond.

Within 24 hours, Reilly successfully petitioned the Supreme Judicial Court to put Harvard Pilgrim into receivership, a dramatic step akin to bankruptcy protection, and one that put the insurer under state control. “We all realized this was bigger than any one of us,’’ Reilly said.

The crisis would test the limits of Baker’s political and business skills, but Harvard Pilgrim survived. Today, the company is slightly smaller than in 2000, but on firm financial footing. It wins top scores for customer satisfaction.

And now Baker, 52, is pointing to his role in rescuing Harvard Pilgrim as a reason voters should elect him governor in 2010. He is also highlighting his 1990s budget-slashing work in the Republican administrations of governors William F. Weld and Paul Cellucci.

“I’m actually the only person in this race who’s actually been part of two successful turnarounds,’’ Baker said last week, after making his candidacy official.

Many in healthcare view him as Harvard Pilgrim’s savior. Yet many see a less heroic story line, noting that Harvard Pilgrim probably would not exist if the state had not created a public-private alliance to save it from bankruptcy.

Philip W. Johnston, secretary of Health and Human Services under former governor Michael Dukakis and current chairman of the Blue Cross Blue Shield of Massachusetts Foundation, noted that the action was at odds with Baker’s free-market philosophy, one he espoused in the 1980s as cofounder of the Pioneer Institute, a libertarian-leaning think tank.

Baker “metamorphosed from [a] conservative, Pioneer Institute libertarian to government interventionist in the blink of an eye’’ when the company and his reputation were on the line, Johnston said. “The reality is that Harvard Pilgrim was saved by the government,’’ he added. “There’s great irony in that.’’

Weld hired Baker in 1991 as an undersecretary in the Office of Health and Human Services, but he quickly rose to secretary, becoming the youngest member of Weld’s cabinet. Baker recommended major cuts in welfare and Medicaid programs and closed hospitals.

Judy Meredith, a longtime human services lobbyist, described Baker at the time as “the most charming slash and burn artist that this human resources advocate has ever seen.’’ In a recent interview, she said Baker sent her a thank you note after reading the quote in the newspaper.

“I guess he took the charming part as a compliment,’’ she said.

When Baker stepped into the top job at Harvard Pilgrim in 1999, the company had posted its first ever operating loss, $94 million for 1998. Its chief executive and chief financial officer had resigned under pressure. Baker said at the time that he could turn the company around in 60 days.

Five months into his tenure, Baker discovered the massive accounting error. He called then-Insurance Commissioner Linda Ruthardt, whom he had worked with in the Weld and Cellucci administrations, and asked to meet. Baker was “pale and very, very serious,’’ she recalled, and told her that Harvard Pilgrim faced insolvency because of the $58.5 million mistake.

Harvard Pilgrim went into receivership, with regulators from Ruthardt’s office, lawyers from Reilly’s office, and Baker’s management team working to create a turnaround plan that would ultimately be approved by the Supreme Judicial Court.

Baker had previously closed Harvard Pilgrim operations in Rhode Island, leaving 125,000 subscribers to seek other coverage. Under receivership, he continued to find ways to save money. He laid off 200 of Harvard Pilgrim’s 4,000 employees over a three-year period, and imposed insurance premium increases on customers. He and his staff also renegotiated provider contracts and hired a contractor to handle information technology and claims processing.

Under the turnaround plan presented to the court, Reilly and Ruthardt asked that Harvard Pilgrim be allowed to increase the value of its vast real estate holdings by considering its current market value, not its replacement value. Experts at the time said the change added $70 million to Harvard Pilgrim’s assets.

Harvard Pilgrim had a negative net worth, so the plan called for the insurer to issue surplus notes, or the equivalent of an IOU to bondholders, promising to return their investment plus 9.5 percent interest, to be paid at the insurance commissioner’s discretion. The arrangement also meant that the holder of those surplus notes would be paid back last if the turnaround failed.

A quirk of insurance accounting allowed Harvard Pilgrim to characterize the bonds as equity instead of debt.

So with a couple of deft strokes of the accountant’s pen, Harvard Pilgrim went from being $88 million in the red to $178 million in the black in 2000.

In an interview with the Globe last week, Baker described the state’s role as an “important backstop to the turnaround.’’ But, he added, “They didn’t bail us out; there was no government money in this transaction at all.’’

“The role of [Reilly] and the role of the Division of Insurance provided a sort of comfort to the public that the issue was being managed professionally and competently by a state office,’’ Baker said.

Competitors credit Baker for the way he tackled a problem not of his making. James Roosevelt Jr., chief executive of Tufts Health Plan, said Baker showed “strong leadership.’’ But like Johnston, Roosevelt said it was the “unusual method of debt financing’’ that ultimately saved the day, referring to the revaluing of real estate and loans.

Harvard Pilgrim emerged from receivership after five months, although limited state oversight continued until 2006. During those years, the insurer paid off debt and worked to keep subscribers from defecting with a $500,000 radio ad campaign featuring Baker’s confident presence. By March 2000, the efforts appeared to be working. Harvard Pilgrim had paid more than $388 million of its debts to hospitals and other healthcare providers.

But there were other major setbacks.

Partners HealthCare Inc., the state’s largest healthcare system, demanded increased payments from insurers in exchange for allowing patients access to their network. Partners’ hospitals, including the prestigious Massachusetts General Hospital, had already cut a deal with Blue Cross for higher payments and were pressuring Tufts and Harvard Pilgrim for the same.

Baker objected. He had already raised prices and he feared additional increases would cost the company members. He also criticized what he called “the Partners effect’’ - other providers realized they too could increase their rates, forcing everyone’s healthcare costs to go up.

In an interview last year, Sam Thier, Partners’ former chief executive, recalled meeting with Baker and Reilly at the time. Thier said they painted a bleak picture of Harvard Pilgrim’s finances, calling it their “End of Western Civilization as we know it’’ presentation.

“It was just kind of silly,’’ Thier said.

In the end, Partners won. By June 2001, Harvard Pilgrim agreed to pay steep fee increases. Baker passed on the costs to employers, charging premiums that were 10 to 15 percent higher. By 2002, membership dropped to 751,000 members, a 10-year low.

Baker did not back off of criticism of Partners, testifying at a 2003 Federal Trade Commission hearing that Partners and other healthcare providers’ growing market power had made them “virtual monopolies.’’ And his criticism of Partners continued into last year, when Baker in a series of stories by the Globe’s Spotlight Team blamed dominant providers like Partners for inflating healthcare costs in the state.

Partners’ chairman, Jack Connors, referred to Baker as “a first-class human being’’ and “formidable candidate.’’

“We, on the providers side, have very good relationships with the CEOs of major plans,’’ Connors said in a recent interview. “It doesn’t mean we spend a lot of time hugging and kissing.’’

Yet to this day, tensions between Partners and Harvard Pilgrim appear to persist. At a November Arthritis Foundation of Massachusetts dinner honoring Baker with a lifetime achievement award, Partners executives were noticeably absent from the audience of about 400, even though Connors bought several tables.

One of the missing Partners executives was Baker’s brother, Alex, chief operating officer at Partners Community Healthcare.

Charlie Baker said recently that his brother had a scheduling conflict, and that despite what some might believe, Partners’ absence did not signal a rift.

“I have good relationships with all those people,’’ he said. “I always have.’’

-

Megan Woolhouse can be reached at mwoolhouse@globe.com.

-

-----------

The Boston Globe, Op-Ed, JAMES ALAN FOX

"Baker's half-baked and pricey support for capital punishment"

By James Alan Fox, July 30, 2009

“No new taxes,” pledged gubernatorial hopeful Charlie Baker, a political position likely to resonate with countless Massachusetts voters mired in their own financial crises. In the next breadth, the Republican candidate, regarded by many as a fiscal wizard, declared his support for capital punishment, a posture also guaranteed to appeal to those citizens who yearn for seeing the state’s death penalty restored. Leaving aside the many compelling arguments against capital punishment, reinstating the supreme penalty would be rather difficult without raising taxes.

Notwithstanding my hesitancy to judge justice purely in terms of dollars and cents, there is one absolute truth about capital punishment: it costs a state millions to establish and manage the process. When a prosecutor chooses to seek the death penalty, the state incurs unusually large expenses not so much related to the punishment itself, but associated with the trial and appellate review. For example, an analysis of capital trial costs in Maryland published last year by the Urban Institute estimated the average expense of a successful death penalty prosecution to be about $3 million, triple the lifetime cost of a capital-eligible case in which prosecutors did not ask for death.

The last Massachusetts capital punishment bill that died on Beacon Hill in 2007 called for layer-upon-layer of procedural safeguards in an attempt to make the system “foolproof.” Its strongest backer, then Governor Mitt Romney, called it the "gold standard" for the administering the death penalty. Romney’s words were never more prophetic and true. Apparently, price was no object.

Had Romney been successful on his own campaign pledge to reinstate capital punishment, the Commonwealth’s economic burden would have been considerably higher than Maryland’s. Under the failed Massachusetts proposal, taxpayers would have been obliged to pay for defense counsel chosen from a list of particularly experienced attorneys and given wide latitude in hiring consultants and expert witnesses, for a jury trial lengthier than most, for a sentencing process involving a separate jury to determine if there was "no doubt" with regard to a defendant's guilt, for a review by a group of independent forensic scientists with oversight from a death penalty review commission, and for several rounds of state and federal appeals also with superior legal representation. Each capital prosecution would have been the new MassMillions.

Charlie Baker, given his many years heading up Harvard-Pilgrim, knows a lot about the high cost of heath care and how that can impact the state budget. If he were at all familiar with the capital punishment landscape, he would know that in recent years several states—including New Jersey, New Mexico and New Hampshire—have abandoned or abolished the death penalty precisely because of the exorbitant price tag. Baker would also know that the Massachusetts murder rate ranks 14th from the lowest nationally and is just about half the rate for the United States as a whole.

At least in terms of murder prosecution, the Massachusetts justice system is hardly broken. But if Charlie Baker has his way, the state could go broke trying to fix it.

-

James Alan Fox is the Lipman Family Professor of Criminal Justice and Professor of Law, Policy and Society at Northeastern University. He was the 2007 recipient of the Hugo Bedau Award for excellence in death penalty scholarship given by the Massachusetts Citizens Against the Death Penalty.

-

-----------

"Gubernatorial candidate Baker downplays role in financing of Big Dig"

By Martin Finucane, Boston Globe Staff, August 12, 2009

Republican gubernatorial candidate Charles D. Baker downplayed yesterday his past involvement in the financing of the Big Dig, seeking to distance himself from the costly project as Democrats try to make it an issue in the 2010 campaign.

In a live chat yesterday on the Globe’s website, boston.com, Baker said the project was a “25-year financial headache for all involved, Democrats and Republicans alike.’’

Baker pointed out that he was state secretary for administration and finance for four years, from 1994 to 1998, and that he had already moved on to his job at Harvard Pilgrim Health Care in 2000, when cost overruns on the Big Dig came to light.

“Moreover, [the state Executive Office for Administration and Finance] had no role in directly managing the project. It was managed by the Turnpike Authority, an independent authority,’’ he said.

The project’s most startling cost overruns, a hidden $1.4 billion, were disclosed in 2000, after Baker stepped down as secretary. But the first of the project’s three peak spending years began in 1998, before Baker left, when costs reached $4 million a day. The overall projected price tag had already reached $10.8 billion by the time he left. It would eventually reach $15 billion.

Yesterday, Baker blamed the Massachusetts Turnpike Authority for issuing swaptions, complex credit transactions, in 2002 and 2003, saying it “screwed up their financials.’’

Responding to a Globe report on his role in the turnaround of Harvard Pilgrim, Baker credited state officials with playing “critical roles’’ in helping the company emerge from state receivership and said he was sorry if he ever “implied otherwise.’’

Weighing in again on last week’s forced resignation of Daniel A. Grabauskas as MBTA general manager, Baker said that “canning him was a mistake.’’

“His departure is a loss for the T, the state, and its riders,’’ he said.

Baker insisted that he has no interest in running for higher office than governor. “None,’’ he said. “Nada. Zero. Zip.’’

-

Noah Bierman of the Globe staff contributed to this report.

-

-----------

"Candidates raising cash for 2010 gov.'s race"

By Steve LeBlanc, Associated Press, Sunday, August 16, 2009